Public offices have their own character as an investment… often an ideal one if the agency will stay for many years, but sometimes a good stop-gap compromise when looking for a tenant in a poor time in an economic cycle.

Office space can have it’s character changed drastically by the type of tenant mix a landlord aims for…or who shows up interested in paying rent. All types can be financially rewarding.

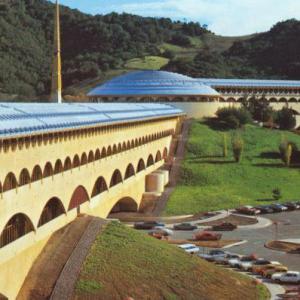

I’ve pictured the iconic Frank Llyoyd Wright Civic Center here. No, this is not leased space, but it serves as an example investors should keep in mind. City’s and Counties will often lease space for some of their operations. I have even dealt with Caltrans, the agency responsible for maintaining our roads in California, who will take office space from time to time to keep engineers near large projects.

Elsewhere on the site I’ve pictured pure office space leased long term to a County specialty medical facility and mention office buildings and a retail center that the county library had leased for a few years at a time.

Properties like post office buildings in other states or localities sometimes come for sale and usually fit the “Triple net lease” category. I’ll write a blog post soon on “NNN” property investments.