I try not to repeat myself on fundamentals of demand and demographics sought by each type of real estate but by reading each section, I hope you’ll gain some insight through examples. Multi-tenant-Industrial-Properties

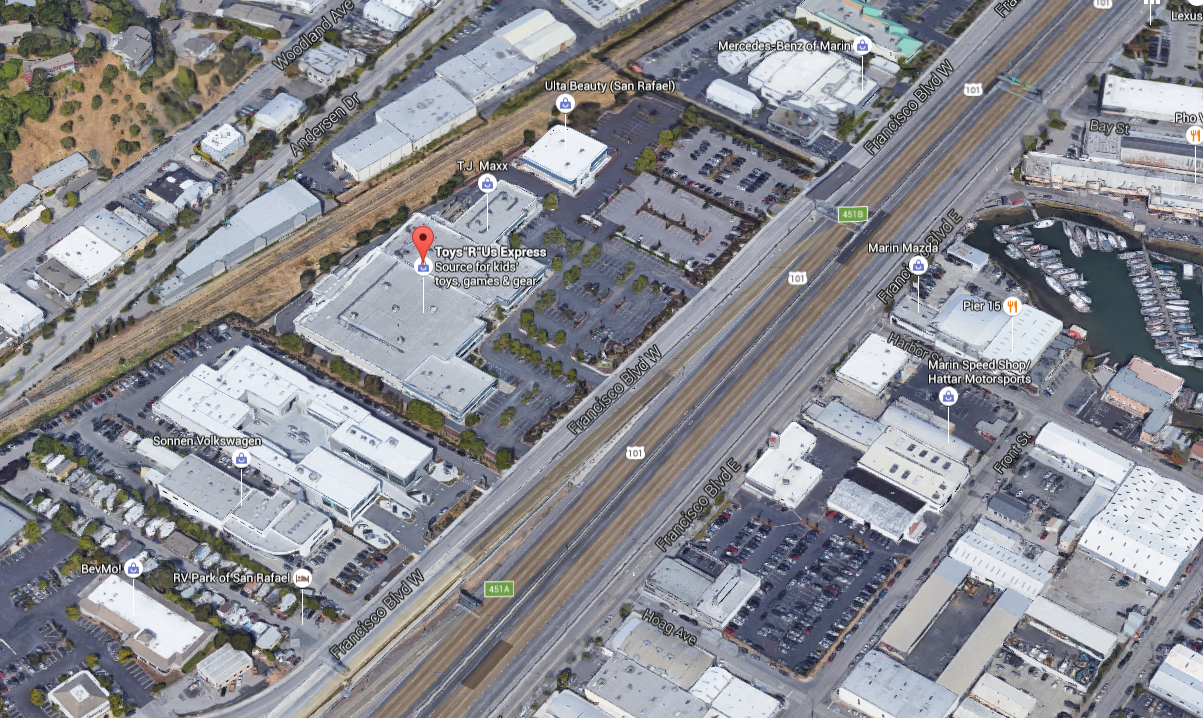

“Freeway Frontage Real Estate” is pretty self-explanatory on the surface: businesses like new car sales as well as lumber yards, and mattress retailers serving the region profit from the advertising value of people passing they signs each day will have their business in mind on the occasions they make special purposes.

There is also the logistical factor related to easy access to people in multiple communities, and being located off routes they drive on daily. Many of the highways turned to freeways were developed in the age of the large automobile and built through less developed swaths of an area at the time(often even agricultural).

There is a big cross-over between “power centers”, and the “freeway frontage” designation I’m making. As I describe in the power-center section, many national and regional retail chains have settled on free standing or smaller locations common in decades past.

I break out this section because there are frequently some reasonably sized properties for moderate sized investors(millions, not tens of millions) to get involved with.

Some of the boulevards are not directly visible from the freeways either.

A single tenant, or two or three tenant building that would serve a carpet retailer, or a hot tub supplier (two I’ve had experience with in Marin) can make for a low maintenance building to own.

While vacancies can sting, especially during recessions that hit retailers of major discretionary purchases hard, these are often fundamentally good properties because on the increasing scarcity of sites with good parking and access as properties in affluent areas get redeveloped as I explain in other sections.

Your eventual exit-strategy could also include selling to a developer that is willing to build parking and put more square footage on a given lot, if premiums for office, residential or retail rents become pronounced.

I’d describe that as “being in the path of development” bonus you can get for properties who’s rents justify the purchase price even while they are developed in a low density way.