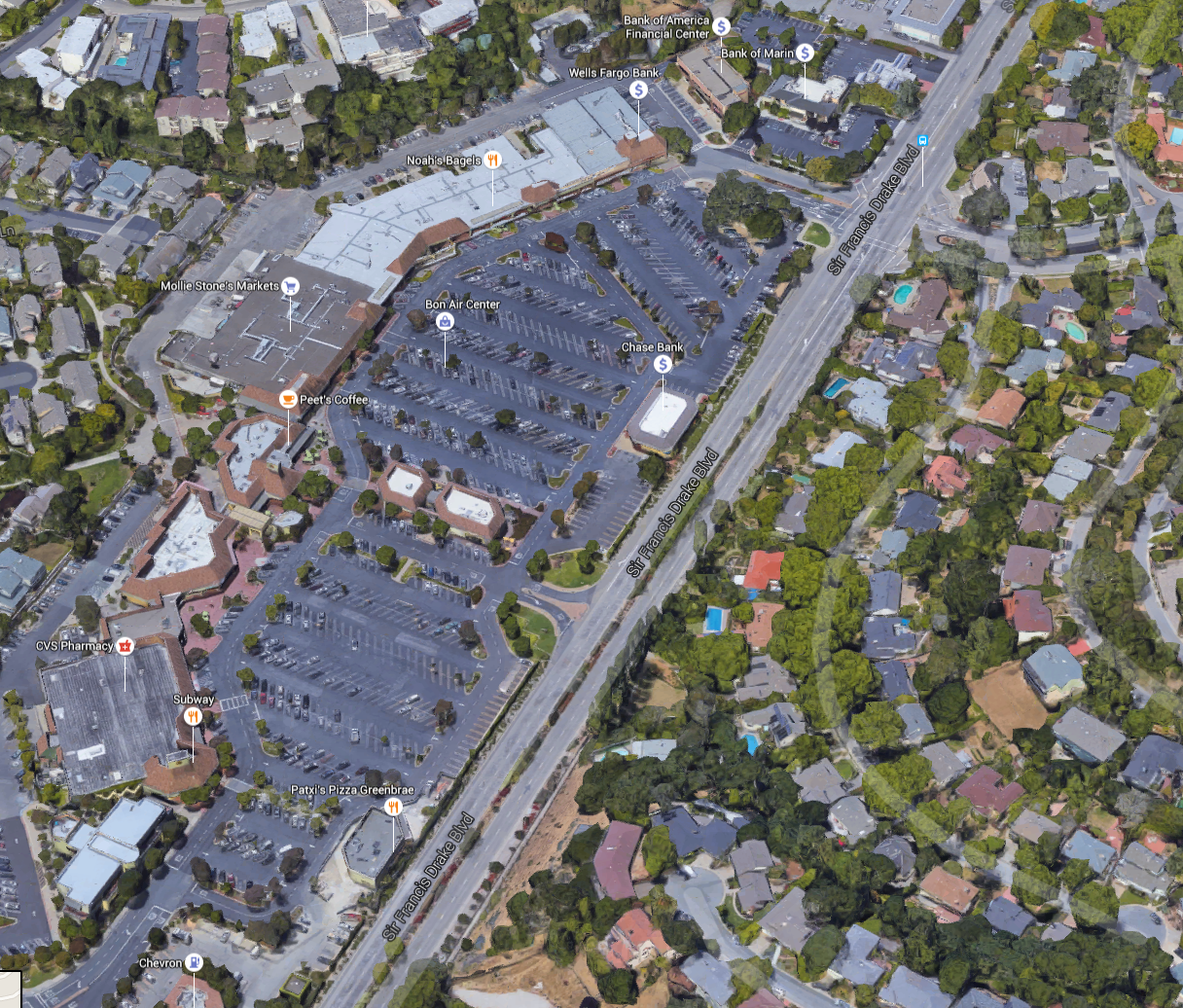

Neighborhood commercial centers are those small “strip malls” with a big parking lot in front, a super-market, usually a drug-store, and a collection of smaller stores that every neighborhood needed like dry-cleaners, and in modern times, a Starbucks.

These centers can vary substantially in size, frequently based upon how large of an arterial street they are located on and if they have easy freeway access.

Even the smaller neighborhood centers often have “pads”, a name for a free-standing building within the parking lot, for thinks like drive-through fast-food restaurants, and banks seeking extra identity/visibility than when they located in a strip storefront in the same centers.

Historically, these centers replaced the old ‘main-streets’ as people moved from rails to automobiles. At the same time markets became larger ‘super’ markets demanding larger premises in addition to the easy parking the new centers provided.

Smaller Investors are usually “not invited to this game” solely because of the cost related to their size. Still, in the low tens of millions of dollars for the smaller centers, these can make excellent investments for moderate family fortunes looking to diversify from being entirely in the stock market. They can also be decent vehicle for moderate sized entrepreneurs selling shares of ownership to smaller investors.

There is a good deal of transparency to the income of these properties and substantially less second guessing of tenant improvement allowances and shorter lease terms you’d often see in a similarly sized(in dollars) office property.

Larger properties of this type are usually owned by pension funds….even the state of Florida retirement fund owned a couple of this sized property in Marin county in the 1990’s.

As I harp on continually at this site, scarcity and growing density is the friend of an investor of types of property based mostly on the land value. These properties fit that description, as well as having the “path of development” alternative cash out opportunity if multi-story parking and commercial space ever gets built on them.

Caution Too small a center can be a problem; this is especially so in areas with less constraint to development of larger, more modern centers serving the same community. In many(even in some quiet affluent neighborhoods) the smallest centers became obsolete as supermarkets became even more “super” in the size they demanded. If the chain-market leaves, without an anchor tenant providing foot-traffic for ancillary tenants the other tenants may have a hard time staying in business(let alone pay a decent rent). The space they vacate is too big for almost all sole-proprietor type businesses even as it was too small for the chain retailer.

I would be happy to assist groups with the purchase of this sort of property anywhere throughout California, however I could only recommend the purchase a small percentage of the existing properties due to the cautionary issues I raise.